Spain has been increasingly active in aligning with EU-climate goals, particularly in the area of electric vehicles (EVs), clean energy, and transport emissions. Below are the major policies, targets, and challenges for Spain and how it complements / contrasts with what the EU and Norway are doing.

Key Targets & Policies in Spain

- 5 million EVs by 2030

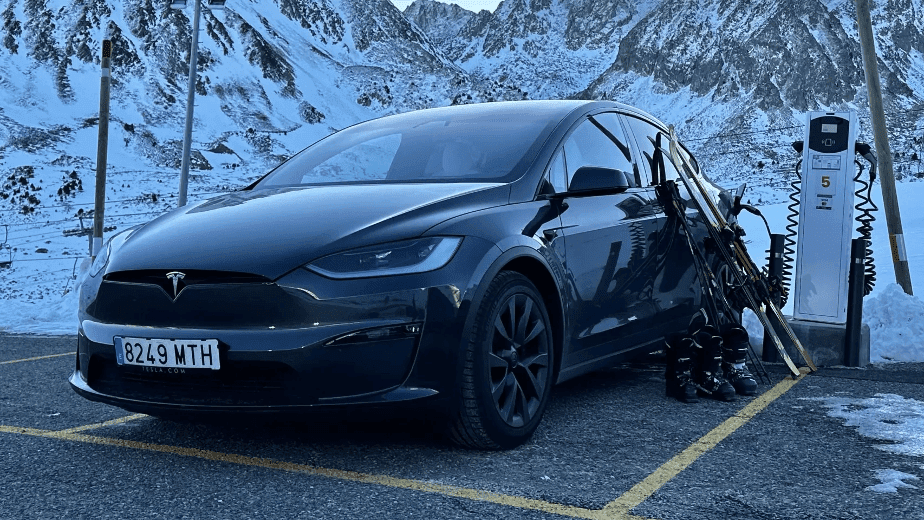

As part of its updated National Energy and Climate Plan (NECP) for 2023-2030, Spain has reaffirmed the goal of having five million electric vehicles circulating by 2030. - MOVES III Incentive Programme

- Spain’s “MOVES III” programme (started in 2021) is central to EV adoption efforts. It provides subsidies for electric vehicle purchases and for developing charging infrastructure.

- In April 2025, Spain approved a €400 million extension of MOVES III, with retroactive effect from 1 January 2025 through 31 December 2025. This ensures continuity so that there is no gap in support for EV buyers or charger installations.

- The extension carries features like a 15% income tax (IRPF) deduction for EV or charging infrastructure buyers, simplification of administrative procedures, and grant amounts of up to ~€7,000 for passenger EVs (especially if scrapping old high-polluting vehicles).

- Charging Infrastructure & Regulatory Alignment

- The government is working to expand publicly accessible charging infrastructure, as required under EU rules like AFIR (Alternative Fuels Infrastructure Regulation).

- Efforts are underway to streamline permitting processes, which have been a barrier to deploying EV chargers especially in certain regions.

- Industrial Policy & Battery Manufacturing

- Spain is attracting large investments in battery factories. A significant example: Stellantis and CATL plan to build a €4.1 billion battery factory in Zaragoza, to be operational by end of 2026.

- Green Energy & Renewables Integration

- To support the growing electricity demand from EVs, Spain is pushing renewable generation (solar, wind), energy storage, grid upgrades. The NECP envisions substantial new capacity across renewables, storage, and hydrogen.

- Emissions Commitments

- Spain has raised its overall emission reduction target in its 2023 revised NECP: from ~23% to ~32% reduction in greenhouse gas emissions (compared to 1990 baseline) by 2030.

- Non-ETS (non-Emissions Trading System) sectors (like transport) have particularly strong targets and are benefiting from programmes like MOVES.

What’s Working Well & Spain’s Strengths

- Clear targets (e.g. 5 million EVs) give direction.

- Generous incentives make EVs more affordable for many consumers. Especially the combined mechanism of purchase grants + tax deductions.

- Government backing for battery plants shows industrial commitment, not just subsidies. Having local battery production can reduce costs and supply chain dependence.

- Renewables expansion helps ensure that EVs are charged with increasingly clean electricity — improving their actual emissions footprint.

- Regional plans, like in Catalonia, show sub-national governments getting involved with investment and infrastructure.

Major Challenges for Spain

- Uptake speed: While targets are ambitious, EV adoption is uneven. Some autonomous communities are slower, and administrative delays for applications or subsidy processing have been criticized.

- Charging infrastructure gaps: Public fast chargers, highway charger coverage, rural area deployment are still less developed. Ensuring sufficient density, power, and reliability remains a hurdle.

- Equity & regional variation: The level of subsidy, access to incentives, speed of implementation varies by region. Some areas lag behind.

- Cost and consumer behavior: Upfront cost of EVs, even with incentives, can be high. Consumer concerns about range, maintenance, charging access still matter.

- Grid & power supply challenges: To handle increased load, grid upgrades, renewable energy capacity, energy storage etc. must scale. Otherwise, risk of delays or higher costs.

How Spain Fits into the EU + Norway Context

| Dimension | Norway | EU Average / Policy | Spain |

|---|---|---|---|

| Target for new ICE sales ban | Norway aiming for 2025 zero-emission new car goal (sooner than EU) | EU mandates 100% CO₂ emission reductions for new cars/vans by 2035 (“zero emission” requirement). (www4.unfccc.int) | Spain aligns with EU deadlines; its big push is via EV numbers + infrastructure up to 2030. It has yet to set a national ban ahead of EU law but follows EU regulations. |

| EV Market Share / Penetration | Very high; in many months Norway sees >90% new car registrations being electric. | EU average rising steadily but varies a lot by country. | Spain is improving, but EV share still lower than northern European countries; needs rapid catch-up in many regions. |

| Incentives / Subsidies | Very generous; often exemptions from taxes, free or low cost EV perks; strong infrastructure. | EU regulates minimum standards, but member states vary. | Spain has MOVES, tax deductions, purchase grants, industrial incentives. Generous in relative terms but administrative delays and regional differences reduce effectiveness. |

| Industrial capacity / Battery manufacturing | Norway less of an EV manufacturing hub compared to some EU states; strong in electricity generation, but fewer automaker factories. | EU pushing to localise battery production; many gigafactories planned. | Spain is becoming a major battery hub (e.g. Zaragoza factory), attracting investment. This helps reduce reliance on imports and aligns with EU’s industrial strategy. |

| Renewables + Grid Cleanliness | Very clean electricity (hydro dominant) so EVs almost entirely low carbon. | Varies; many EU states still generate electricity with significant fossil fuel mix, though trend is toward renewables. | Spain’s renewables are expanding rapidly; ambitious targets for solar, wind, storage. This strengthens the environmental case for EVs there. |

What Spain Should Do More Of / What It Should Add

To make its EV & emissions strategy even stronger, Spain might consider:

- Accelerate charger deployment, especially high-power fast charging along highways and in rural or less dense areas. Ensure these are built out in time to match EV growth.

- Ensure consistency & speed in subsidy/tax incentive administration, to avoid delays and uneven regional uptake. Simplification helps public trust and uptake.

- Public awareness and consumer support: Range anxiety, upfront cost concerns, etc. stronger communication, used EV market support, leasing options, etc.

- Tightening local/regional regulations: Low Emission Zones in cities, tougher standards for polluting vehicles, stricter emission inspections.

- Better integration of EV-charging with renewables + smart grid: Energy storage, grid upgrades, demand response to ensure charging doesn’t overload the system and remains green.

- Encourage fleet electrification (public transport, municipal fleets, taxis, commercial vehicles). These often help early adoption and visible change.

- Stronger emissions regulation aligned with EU/fit-for-55: Continue to push non-ETS sector emissions down, include non-tailpipe emissions, heavy duty vehicles etc.

Conclusion

Spain is making solid progress: ambitious targets, strong incentives, industrial investments, and renewable power expansion. There are challenges, especially in infrastructure build-out, regional disparities, and speed of uptake. Compared to Norway, Spain is behind in market share / EV dominance, but its trajectory is promising. In the broader EU framework, Spain is one of the more active southern members trying to close the gap.

If Spain continues scaling incentives, infrastructure, renewables, while improving regulatory consistency, it could become a much stronger contributor to EU’s overall emissions goals especially by helping reduce emissions in transport in southern Europe, where climate and air quality are urgent issues.

Comentarios recientes